Worked hard, saved into a pension, and hoped to leave something meaningful to your family?

UK’s latest inheritance tax (IHT) reforms will likely affect you.

These changes are complex, but they have very real consequences for you—not just the wealthy. Let’s break it down into simple terms.

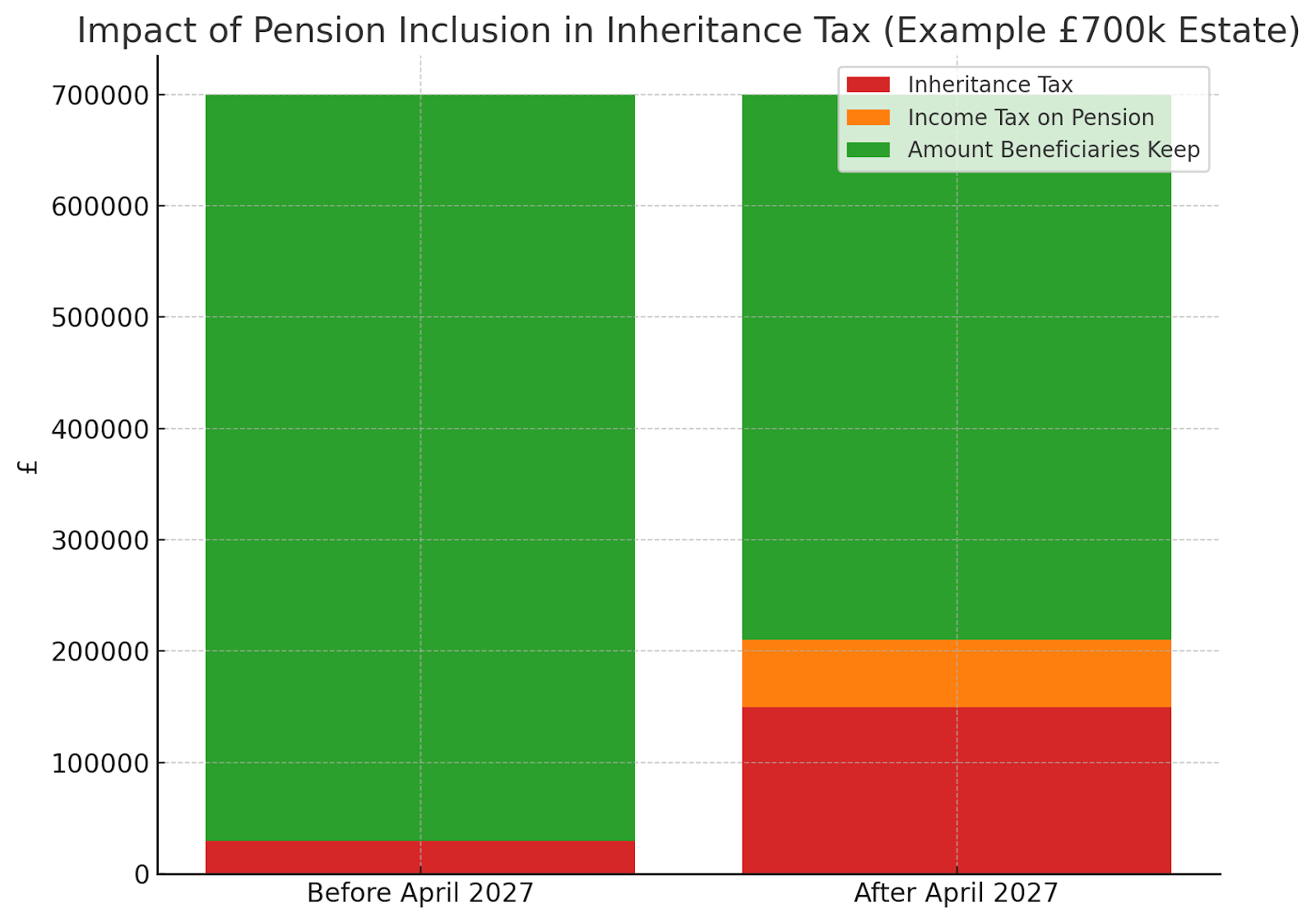

If you look below you’ll see how the April 2027 inheritance tax changes will impact you. The diagram is for a typical £700,000 estate made up of a home and a pension pot. Before 2027, your pensions were shielded from IHT, but after the reform, both IHT and income tax sharply reduce what your beneficiaries will keep.

Estate Scenario used for the above graph:

● Home value: £400,000

● Pension pot value: £300,000

● Total estate: £700,000

● No debts

● Nil-rate band (NRB): £325,000 (frozen until 2030)

● Residence nil-rate band (RNRB): not applied in the example (to keep the chart simple and show the pension effect directly).

Why Should You Care?

Imagine this: you’ve spent your life building a pension pot worth £300,000, and you own a home valued at £400,000.

Under today’s rules, much of that pension could pass to your children with little or no tax. But from April 2027, that same pension will be dragged into the inheritance tax net, cutting deeply into what your family actually receives.

This shift isn’t just about numbers. It’s about whether your loved ones inherit security or struggle.

👉Worried about your taxes? Contact our team of experts by clicking this www.optimyze.accountants.com and put your worries at ease.

.png)